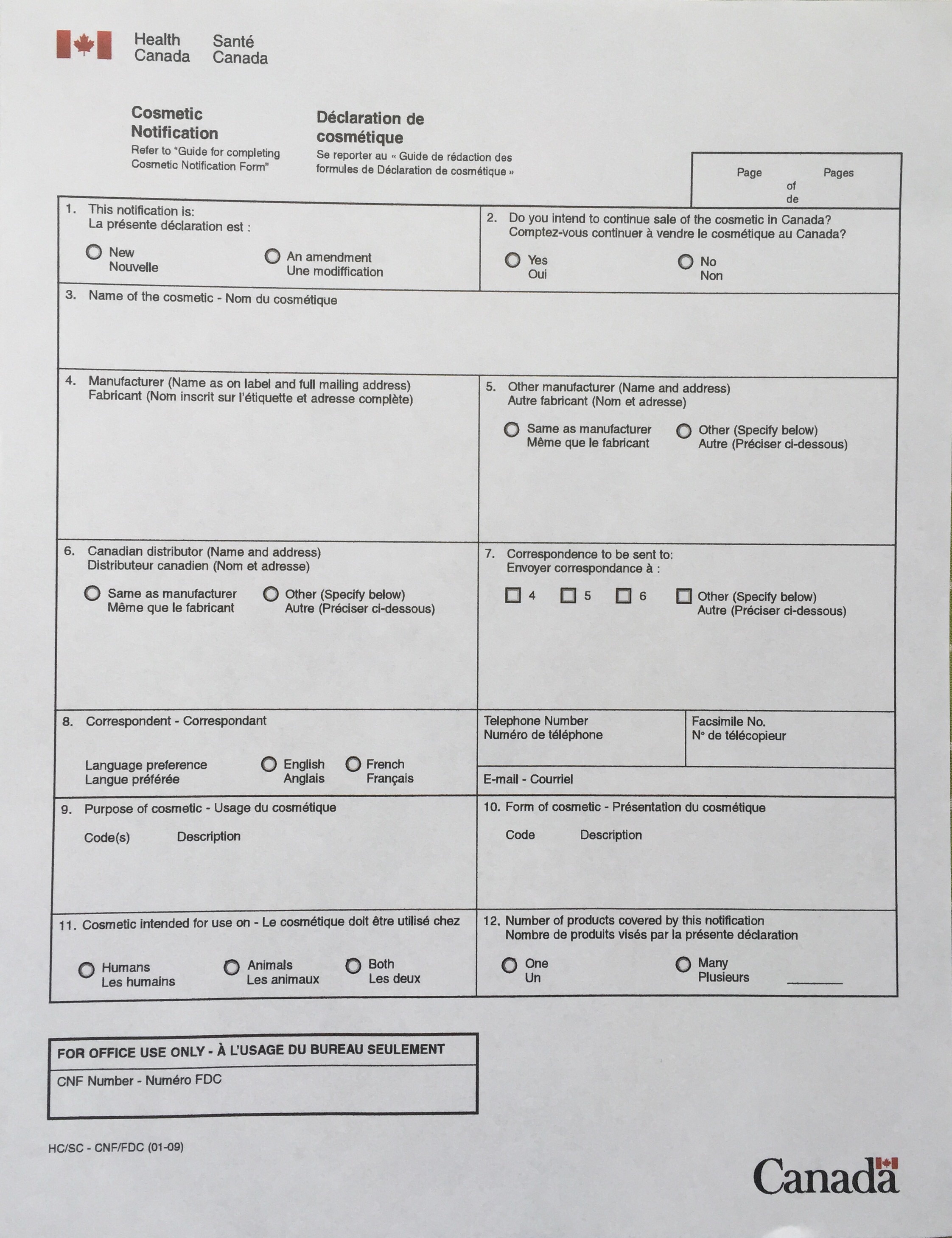

Cosmetic Notification Forms (CNF) – Part Two

Wow, this month is flying by! I apologize for the delay in getting Part Two of this series on CNF published, especially since I know it is on the mind of so many of you these days. In the first part of this series we talked about what a CNF is, and when you would need to file one. If you missed it, you can find it here. Today I’m going to talk a little bit about completing the actual filing process. A blog is not…

Welcome Voyageur!

The Handcrafted Bath & Body Guild is excited to welcome Voyageur Soap & Candle to our list of Vendor Members! Located in Surrey, BC, Voyageur is Canada’s premier supplier for Soap Making Supplies, Cosmetic Packaging, as well as thousands of ingredients for your Aromatherapy, Mineral Makeup and Skin Care products. Handcrafted Bath & Body Guild Members receive an additional 5% discount on top of their Customer Reward Discount, for a total discount of 10%. Visit them today at www.voyageursoapandcandle.com. Not a member yet? Visit www.hbbg.ca now and…

Why Start a Non-Profit Corporation?

When we started discussing forming a new Canadian Guild, there was really no question in our minds that a federal Non-Profit corporation was the only viable option. Let’s look at why: – Since none of the volunteers that form the Board profit from the association, every penny of the Membership fees collected goes towards programs and activities that benefit the Membership; – under the Canada Not-For-Profit Corporations Act, Annual Reports must be filed with Corporations Canada each year, and made available to the Members of…